In this article you will learn:

- How in May 2023, the GBP/EUR rate rose to its highest level since December 2022

- What is the forecast of XTB’s Chief Market Analyst on the GBP/EUR price for the next three months

- How the strength of the GBP (British Pound) since May 2023 is playing a major role in GBP/EUR rate

- How rising interest rates affect the strength of the GBP or EUR

- What are the key factors affecting the GBP to EUR exchange rate in 2023?

- How does the GBP/EUR forex pair work and how to trade it?

The GBP/EUR exchange rate has been on an upward trend in recent months, reaching a high of €1.15 (i.e. £1 buys €1.15) in May having traded back down as low as €1.11 at the start of February. So what could happen to the GBP/EUR exchange rate next and what are the key factors affecting the GBP and EUR? In this article we discuss the key themes influencing current prices and what we might forecast could happen to GBP/EUR prices in the coming months alongside key comments from XTB analysts, global economists and investment banks.

MAY 2023 - GBP/EUR rises to its highest level since December 2022

After trading largely sideways for much of the past six months from 14th December 2022 to 3rd May 2023, prices started to trade with more volatility in the past weeks which helped the exchange rate to break out of its trading range and reach new highs for the GBP. Previously the cross rate had been stuck in a trading range between €1.10 and €1.14.

Chart - EUR/GBP rate breaks out of its range in May 2023 thanks to GBP strength

![GBP strength pushes EUR/GBP rate out of its range]() Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

XTB’s Chief Market Analyst shares his latest GBP/EUR price forecast for the next three months

On where prices could turn to for the GBP/EUR, Chief Market Analyst at XTB Walid Koudmani said:

“Much of what’s driving this forex pair relates to the upturn in the strength of the UK pound (GBP), which has benefited immensely from rapidly changing expectations in the market towards UK interest rates. Previously it had been expected that UK inflation was likely to fall sharply from March but this just has not been the case. As a result, the Bank of England is now likely to keep hiking UK interest rates and this is helping to support the pound against major competitors such as the EUR.

Much of whether the GBP/EUR rate continues to climb will be based on the strength of UK inflation data in the next three months (April, May and June). The sharp fall in wholesale energy prices - where spot natural gas prices are trading more than 50% below prices in February - should drive a slowdown in inflation. UK inflation data for April is set to be released on 24th May 2023 and it’s expected to show a faster slowdown from 10.1% in March to 8.3% in April. If we do see such a cooling in inflation, that will help calm fears that UK inflation remains hot and we could start to see some profit taking in the GBP, which could as a result push the GBP/EUR lower. However, perhaps the sharpest reaction could come if inflation for April comes in above 8.5%. That would likely lock in further interest rate rises and could see a second wave of demand for the GBP.“

The strength of the GBP (British Pound) since May 2023 is playing a major role in GBP/EUR rate

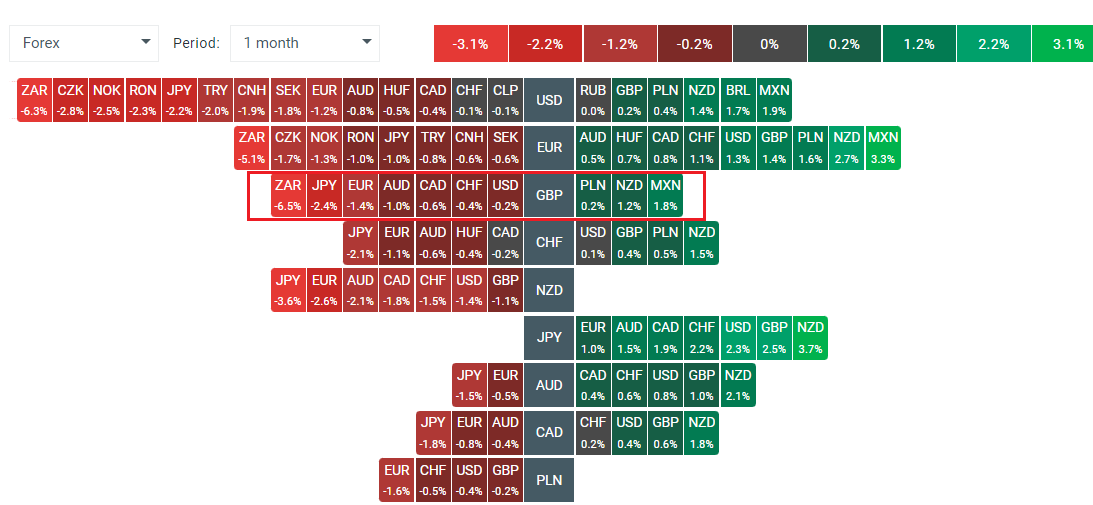

In the past month, the GBP has strengthened against most major currencies. In fact, its value has risen by between 0.2% and 6.5% against a basket of currencies such as the USD (US Dollar), TRY (Turkish Lira) and JPY (Japanese Yen). This tells the story that GBP strength is playing a significant role in the GBP to EUR price and likely forecast in months to come. In the past month the GBP has fallen in value against three major currencies only; the Polish Zloty, the Mexican Peso and the New Zealand dollar.

Chart - Heatmap of GBP performance against most major currencies in May 2023

![GBP strength aganist most major currencies since May 2023]() Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

So what are the reasons behind the recent GBP strength which helped prices break out of its trading range? Let’s take a look at three key drivers:

1. Rising interest rates / Bank of England policy

In May, the Bank of England (BoE), the UK’s central bank, made its twelfth consecutive interest rate hike, lifting UK interest rates to 4.%, the highest since 2008. There had initially been hopes that the BoE would soon be reaching the highest point for UK rate hikes with macroeconomic data starting to soften, which would enable the BoE’s monetary policy committee to refrain from further rate hikes. However, data has simply not softened to the degree that the BoE had expected in recent months and this has triggered a change in view on rate hikes. The BoE is now expected to continue hiking UK interest rates to 5% or more. This change of view has been a strong factor behind the recent strength of the GBP. You can read more about our UK interest rate predictions here.

2. Higher than expected Inflation

One of the key data points triggering the recent change in stance towards UK interest rate rises is the pace of UK inflation. In March, the UK central bank had predicted that UK inflation would start to slow down from more than 11% to around 9% in April and continue to slow by the end of the year to reach around 4% by the end of 2023. However, UK inflation remained stubbornly high in April with prices growing at 10.1% and exceeding most analyst expectations. Learn everything you need to know about inflation here.

Chart - UK inflation rate (CPI) since 2018![]() Source: Trading Economics

Source: Trading Economics

3. European Central Bank policy

The European Central Bank has also set about hiking interest rates in the euro area, with their latest hike of 0.25% coming in its May meeting lifting rates to 3.25%. This marked its seventh rate hike since July 2022 but did mark its weakest rise with previous hikes coming in at 0.5% or 0.75%. The ECB also signaled during its May meeting that it had further room to raise rates further though most analysts expect one more small hike to come before this tightening cycle likely ends. This has put a cap on EUR gains and has also been a factor in why the GBP has managed to strengthen against its Euro counterpart. Learn about central banks.

How does rising interest rates affect the strength of the GBP or EUR?

Rising interest rates generally make a currency stronger. This is because higher interest rates make a country's currency more attractive to investors, who can earn a higher return on their investments by lending money through the bond market. As a result, there is more demand for the currency, which drives up its value.

There are a few reasons why higher interest rates make a currency more attractive to investors. First, higher interest rates offer a higher return on investment. This means that investors can earn more money by investing in a country with higher interest rates. Second, higher interest rates can help to protect investors from inflation. This is because higher interest rates make it more expensive for borrowers to borrow money, which can help to slow down the rate of inflation.

However, it is important to note that the impact of rising interest rates on a currency's strength can vary depending on a number of factors, such as the country's economic outlook and the level of inflation. For example, if a country's economy is weak, rising interest rates may not have a significant impact on the currency's strength. Additionally, if inflation is high, rising interest rates may not be enough to offset the impact of inflation on the currency's value.

What are the key factors affecting the GBP to EUR exchange rate in 2023?

One factor that could support the pound is the Bank of England's (BoE) plans to raise interest rates. The BoE is expected to raise rates by 25 basis points in June, and another 25 basis points in August, which would lift UK interest rates to 5%, making it far higher than those of its ECB equivalent.

However, much also relates to market expectations on interest rates and its here where there is more uncertainty than in Europe. The market is convinced that more hikes are to come for the BoE but with inflation data remaining stubbornly strong, its still uncertain how high UK interest rates may rise to and just as importantly, how quickly they could fall in 2024 and 2025.

Another factor that could support the pound is the UK's economic recovery. The UK economy grew by 0.8% in the first quarter of 2023, and is expected to grow by 2.5% in 2023. This growth could lead to an increase in exports, which would also support the pound.

However, there are also some longer term factors that could weigh on the pound. One factor is the ongoing uncertainty surrounding Brexit and the UK’s trading relationship with the EU. There are also geopolitical aspects that could impact the performance of the GBP with a general election in the UK expected to come in 2024 which - according to the latest polls - could trigger a hung parliament.

Here are some additional factors that could affect the GBP/EUR exchange rate in 2023:

- The outcome of the French presidential election - geopolitical instability could threaten the strength of the EUR

- The direction of commodity prices - a continued decline in energy prices could quicken the pace of inflation cooling, forcing Central Banks to hold off from further rate hikes

How does the GBP/EUR forex pair work?

The GBP/EUR forex pair is a currency pair that measures the value of the British pound sterling (GBP) against the euro (EUR). It is one of the most popular currency pairs in the world, and is traded on a daily basis by millions of people.

The price of the GBP/EUR pair is determined by supply and demand. When there is more demand for the pound than there is for the euro, the price of the GBP/EUR pair will rise. When there is more demand for the euro than there is for the pound, the price of the GBP/EUR pair will fall.

There are a number of factors that can affect the supply and demand for the pound and the euro, including:

- Interest rates: When interest rates in the UK are higher than interest rates in the Eurozone, investors will be more likely to buy pounds, which will push up the price of the GBP/EUR pair.

- Inflation: When inflation is higher in the UK than in the Eurozone, investors will be more likely to buy euros, which will push down the price of the GBP/EUR pair.

- Economic growth: When the UK economy is growing faster than the Eurozone economy, investors will be more likely to buy pounds, which will push up the price of the GBP/EUR pair.

How do you trade the GBP/EUR forex pair?

Investors can trade the GBP/EUR pair through a forex broker like XTB. When you trade the GBP/EUR pair, you are essentially speculating on whether the price of the pound will go up or down against the euro. If you think the price of the pound will go up, you will buy and profit from every rise in value of the forex pair. If you think the price of the pound will go down, you will sell and profit from every fall in price. Of course, if the prices go against your trade direction, you will suffer a loss.

Here is an example of a CFD trade on GBP/EUR:

Let’s say the Investor believes the pound will appreciate (rise) in value against the euro.

- Investors open a long position on GBP/EUR.

- The investor deposits $1000 to cover the trade

- The investor's broker sets a margin requirement of 5%.

- This means that the investor only needs to put up $50 as margin to control a position of 1000 GBP.

- The price of GBP/EUR rises from 1.1000 to 1.1100.

- The investor closes the position and takes a profit of $100.

- Had the price of GBP/EUR fallen from 1.1000 to 1.0000, the investor would lose $100

In this example, the investor made a profit of $100 on a $50 margin investment. This is a return of 200%. However, it is important to note that CFD trading is a risky investment, and investors can lose money as well as make money. You can learn more about how to invest in Forex CFDs here.

How can you manage your risk when trading GBP/EUR?

Here are some tips on how to manage your risk when trading GBP/EUR forex pair:

- Consider stop-loss orders: A stop-loss order is an order to sell a security if it falls below a certain price. This can help you to limit your losses if the price of the GBP/EUR pair moves against you.

- Consider take-profit orders: A take-profit order is an order to sell a security if it rises above a certain price. This can help you to lock in your profits if the price of the GBP/EUR pair moves in your favor.

- Understand leverage carefully: Leverage can magnify profits, but it can also magnify losses. It is important to use leverage carefully and to only trade with amounts that you can afford to lose.

- Diversify your portfolio: Diversifying your portfolio means investing in a variety of assets. This can help to reduce your risk if one asset loses value.

- Do your research: Before you trade any asset, it is important to do your research and to understand the risks involved as well as the various bits of technical and fundamentals that might help drive price change during your trade.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.  Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.  Source: Trading Economics

Source: Trading Economics