Flash PMIs for May were highlights in today's economic calendar for the European morning session. Data turned out to be very mixed. French release showed in-line manufacturing print and a miss in services data, German release showed weaker-than-expected manufacturing data and a much better-than-expected services reading while data from the United Kingdom disappointed in case of both sectors.

Nevertheless, the general view across Europe is similar - the manufacturing sector continues to contract while the services sector continues to expand. Divergence between services and manufacturing sectors is said to be unusual but is reasoned with strong-than-expected consumer spending that supports services and a slump in Chinese manufacturing activity in Q2 2023 that weighs on manufacturing in Europe as well. Nevertheless, such a mix points to persisting inflation pressures and may lead to a need for more monetary policy tightening.

Start investing today or test a free demo

Open real account Try demo Download mobile app Download mobile appManufacturing PMIs for May

- France: 46.1 vs 46.0 expected (45.6 previously)

- Germany: 42.9 vs 45.0 expected (44.5 previously)

- Euro area: 44.6 vs 46.2 expected (45.8 previously)

- United Kingdom: 46.9 vs 47.9 expected (47.8 previously)

Services PMIs for May

- France: 52.8 vs 54.2 expected (54.6 previously)

- Germany: 57.8 vs 55.5 expected (56.0 previously)

- Euro area: 55.9 vs 55.5 expected (56.2 previously)

- United Kingdom: 55.1 vs 55.5 expected (55.9 previously)

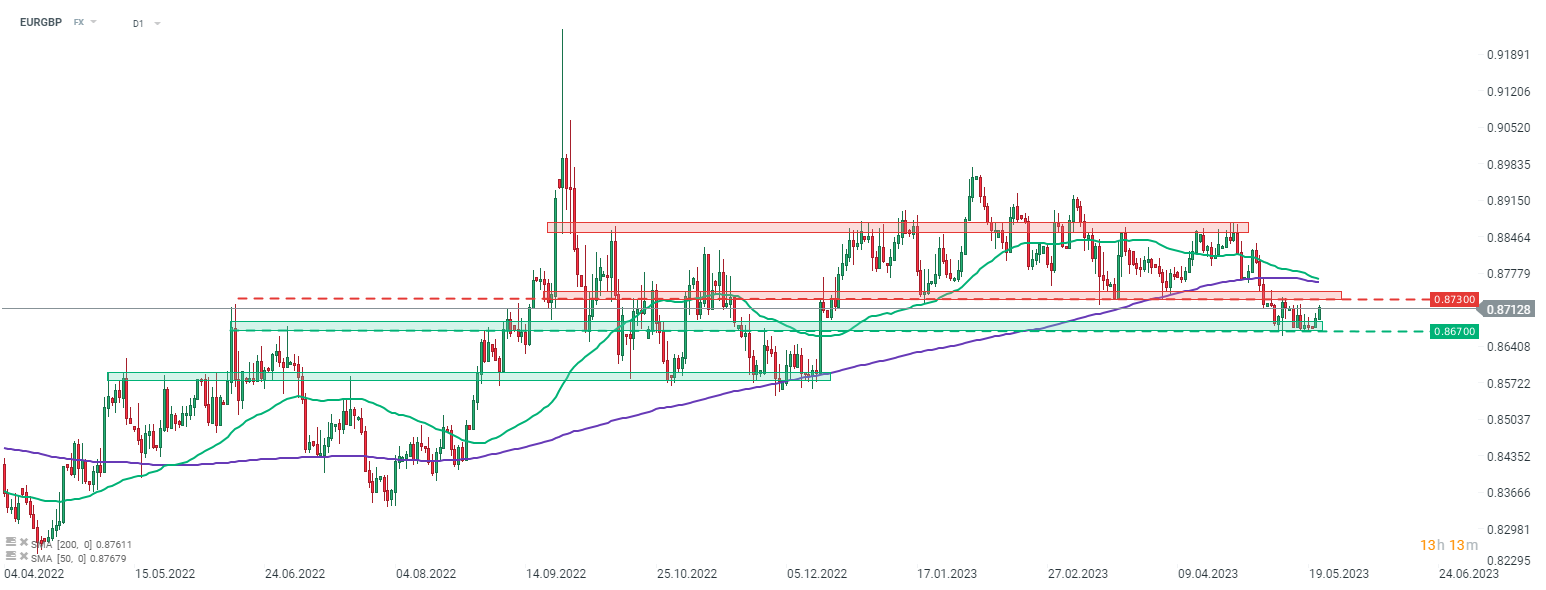

In spite of a mixed PMIs from France and Europe, EUR managed to hold quite firm and did not see any major price reaction. On the other hand, GBP took a hit following a double miss in UK PMIs. As a result, a rather strong upward move on EURGBP can be spotted today. Taking a look at EURGBP chart at D1 interval, we can see that the pair continues a bounce triggered after a failure to break below the 0.8670 support zone. Should the current sentiment prevail, an attempt to break back above the 0.8730 resistance zone may be made soon.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.