Another key takeaways from the speeches of the FED members regarding the current tightening cycle after today's hawkish comment from Bullard:

- Raphael Bostic from the Federal Reserve Bank of Atlanta expressed his preference to hold interest rates steady next month. He believes that the policy actions taken so far are still in the early stages of their impact and wants to observe how things unfold before making further decisions.

- Thomas Barkin, Bostic's colleague from the Richmond Federal Reserve, is keeping his options open and not pre-judging the outcome of the June meeting. He believes that previous rate hikes and tighter credit standards may cool demand and prices, but he still needs to be convinced of this narrative.

- Mary Daly emphasized the importance of not making premature decisions regarding the rest of the year's tightening cycle. She suggests that a pullback in bank lending could have a significant impact, potentially equivalent to a couple of rate hikes.

- Neel Kashkari, another member of the FOMC, sees the decision for June as a close call. He believes that the banking sector strains may contribute to cooling prices, but he wants more evidence before making a decision. He emphasizes the need to keep the possibility of further rate increases open.

Overall, the Fed members have varying views on the appropriate actions for the upcoming meeting. Some advocate for holding rates steady and observing the effects of previous actions, while others remain open to potential rate hikes but want more evidence before committing to a decision.

Start investing today or test a free demo

Open real account Try demo Download mobile app Download mobile app

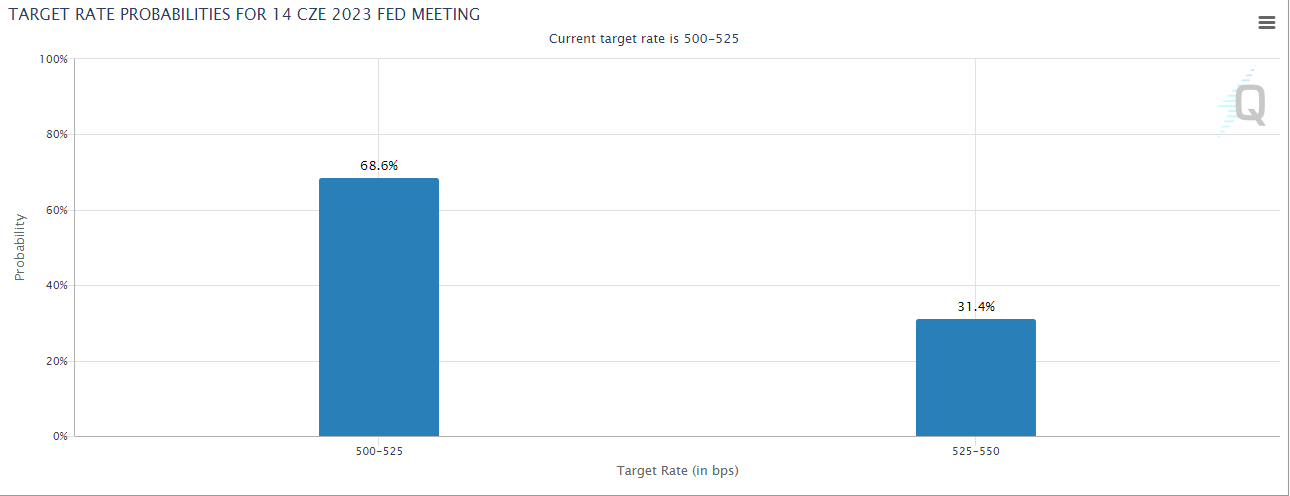

Currently, the markets are assessing a 31% probability of a 25 basis points rate hike at the next FOMC meeting in June. This probability has increased significantly over the past two weeks, driven by strong macroeconomic data and hawkish comments from certain FED members. While it is not yet above the 50% threshold, the likelihood of a rate hike has notably risen.

The EURUSD currency pair is currently trading at 1.08099, and recently rebounced from the lows of 1.07591. Over the past two weeks, we have observed a trend of USD appreciation. This suggests that the US dollar has been strengthening against the euro during this period.

The EURUSD currency pair is currently trading at 1.08099, and recently rebounced from the lows of 1.07591. Over the past two weeks, we have observed a trend of USD appreciation. This suggests that the US dollar has been strengthening against the euro during this period.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.