- The indices on Wall Street trade sideways today

- Markets are awaiting Biden's meeting with McCarthy after the session

- FED members favor further interest rate hikes

Indexes on Wall Street started today's session mostly higher, although volatility in key benchmarks is not high at the moment. US stocks gain in anticipation of a scheduled meeting between President Joe Biden and House Speaker Kevin McCarthy to address the debt ceiling issue. Treasury yields experienced a slight increase due to hawkish comments from Federal Reserve officials, while the value of the dollar remained relatively stable. US Treasury Secretary Janet Yellen warned that without a debt deal, it is likely that the government will default on its dues before June 15, potentially sparking an economic catastrophe. Yellen emphasized her early June deadline for Congress to raise the debt ceiling and dismissed suggestions that the US could avoid defaulting without Congressional action. The ongoing debate among policymakers regarding the conditions for raising the national debt limit remains unresolved, with the aim of reaching an agreement between Biden and McCarthy. McCarthy has expressed his opposition to a short-term increase in the debt ceiling without corresponding spending cuts.

James Bullard indicated today that further rate hikes in the US are as possible and justified. Bullard expects two more rate hikes this year and will support fighting inflation as long as the labor market is strong. The Fed will have to raise the interest rate, perhaps by 50 bps more this year according to Bullard.

Start investing today or test a free demo

Open real account Try demo Download mobile app Download mobile app

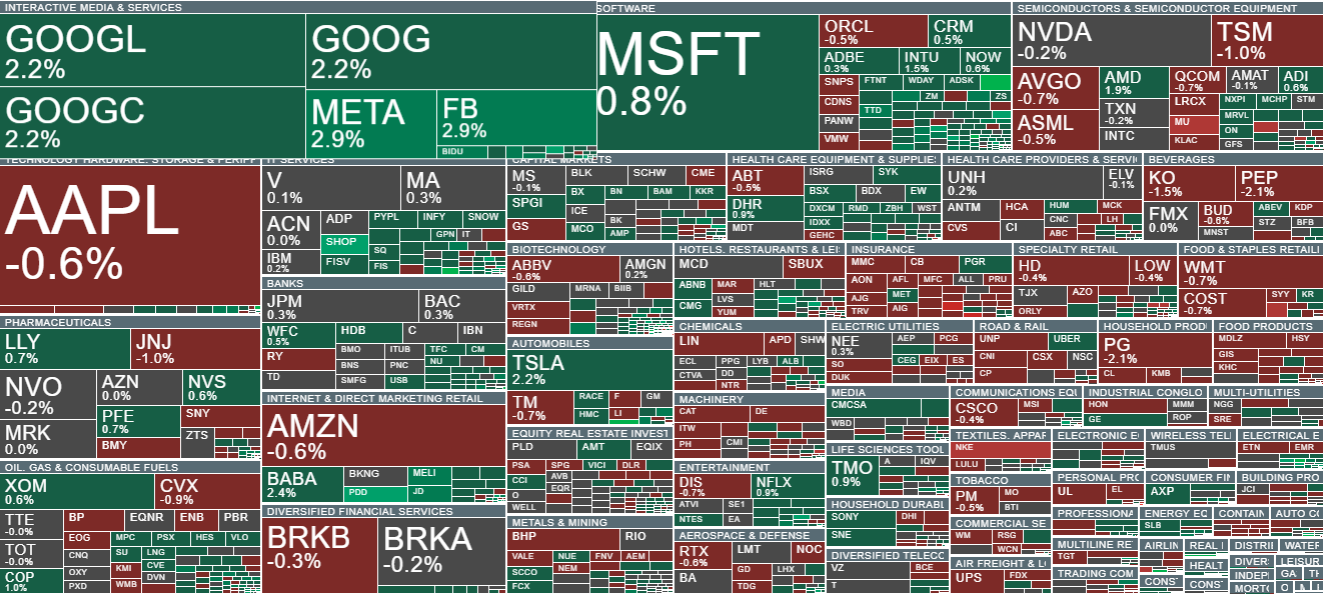

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by Alphabet (GOOGL.US), Apple (AAPL.US) and META (META.US). Source: xStation5

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by Alphabet (GOOGL.US), Apple (AAPL.US) and META (META.US). Source: xStation5

US500 index is currently trading at 4,208 points, remaining below a significant resistance level located around 4,220 points. Today, the price experienced a substantial downward movement, followed by an upward bounce, influenced by fake news regarding the Pentagon explosion, which was later debunked as the tweet was deleted. If the index manages to break above the resistance level at 4,220 points, it could potentially trigger further upward momentum, surpassing the resistance. However, a failure to break above this level may result in downside pressure, potentially pushing the price towards the support level at 4,160 points. Traders and investors should closely monitor the price action around these key levels to gauge the future direction of the US500 index.

US500 index is currently trading at 4,208 points, remaining below a significant resistance level located around 4,220 points. Today, the price experienced a substantial downward movement, followed by an upward bounce, influenced by fake news regarding the Pentagon explosion, which was later debunked as the tweet was deleted. If the index manages to break above the resistance level at 4,220 points, it could potentially trigger further upward momentum, surpassing the resistance. However, a failure to break above this level may result in downside pressure, potentially pushing the price towards the support level at 4,160 points. Traders and investors should closely monitor the price action around these key levels to gauge the future direction of the US500 index.

Company News

- Apple (AAPL.US) declines 0.55% as Loop Capital Markets downgrades to hold from buy in note, saying it now sees a material revenue downside risk.

- Catalent (CTLT.US) shares decline 0.3% after JPMorgan downgraded the biopharmaceutical name to neutral from overweight and cut its price target to $45 from $90, citing limited near-term visibility due to operational challenges and a lowered full-year guidance.

- Meta Platforms (META.US) was hit by a record €1.2 billion ($1.3 billion) European Union privacy fine.

- PacWest Bancorp (PACW.US), one of the regional US lenders that was engulfed in turmoil earlier this month, rises 4% after agreeing to sell a $2.6 billion portfolio of 74 real estate construction loans as part of its plan to shore up liquidity.

- Micron Technology (MU.US) shares are losing more than 4% after China's cybersecurity regulator said the company's products failed a cybersecurity review in the country. As reported in Beijing, Micron products sold in China caused security risks to the IT infrastructure of Chinese supply chains. This means that the use of the company's products will be banned from key infrastructure projects in the world's second-largest economy.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.